What is a Third Party Risk

Third party risk is a risk that may be caused due to an association with any person or organisation that is connected to your supply chain or is executing business on your organisation’s behalf such as a supplier, distributor, agent and/or partner.

Business Search

Company name and known trade names are researched. What business the target entity engages in and how it relates to the organization. Locations, employee base, and industries, among others, of target, factor into the overall risk assessment that is being built.

Organization structure of the company & the beneficial owners behind the company’s structure.

Enforcement Action & Litigation

Whether your target is officially involved in either of these two legal actions; the latter could be criminal but also civil involving claims by the target or against them.

Negative Media & Social Media

Anything formally published in all print publications that have been digitized or web-based reports are screened for any red flags of corruption. There is a wealth of information available on social media, it can be useful but you must consider the source of the information provided. Usually, patterns of negative chatter may be worth noting and can lead to increased monitoring.

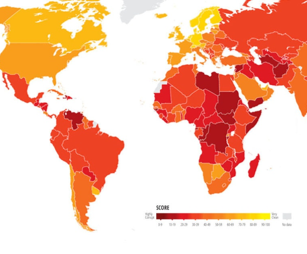

Location & Corruption Perception Index

Corruption Perception Index published by Transparency International is a risk evaluation not related to the company itself but the locations where the company is in operations. Although the location element often drives the initial overall risk rating higher; the results of a due diligence report could be used to reassess the overall level.

Financial Health

This will require screening of financial statements, financial estimates on contingent liabilities, cash flows, Credit ratings & other financial due diligences.

ESG related risks

Any form of environmental degradation, human rights abuses, links to modern slavery, animal welfare breaches or poor employment practices.

Code of Conduct & Operating Practices

Do they match your own standards and codes of conduct, do they operate with integrity within their business.

Do they have a reputation for quality products or services, and adhere to sound operating practices.

Politically exposed person or Corrupt practices

Target company’s executive with a political or a government connection, any associations linked to financial crime or corruption. Check for FCPA enforcement actions or on an SDN list.

Sanctions screening

Screening for sanctions risk is a mandatory requirement for regulated entities across all sectors and is a critical step in the know your customer. Organisations must ensure that they do not transact with any blocked entity. Sanctions can be applied against but not limited to a country, entity, individual, organisation and vessel. Some of the major Sanctions list that we monitor are of OFAC, UN & EU.